41 alabama state retirement

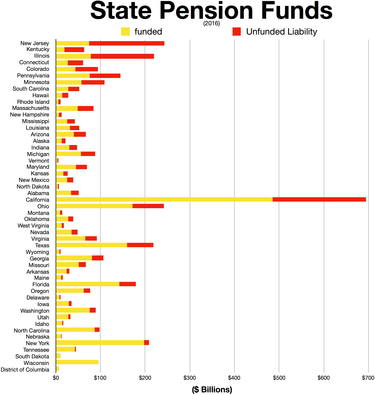

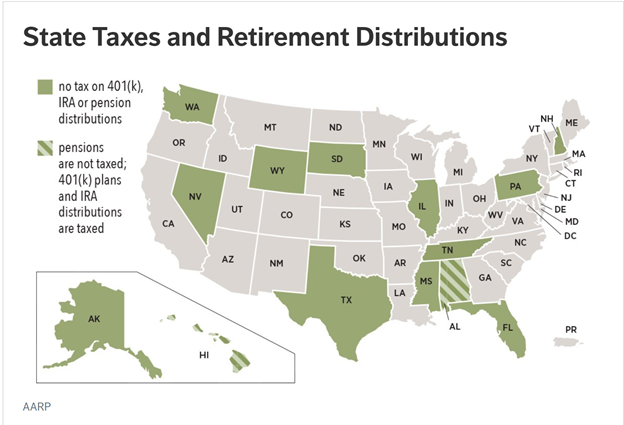

Alabama Retirement Tax Friendliness - SmartAsset Are other forms of retirement income taxable in Alabama? Some types of retirement income are taxed in Alabama. Income from retirement accounts like an IRA or a 401(k) will be taxed as regular income at Alabama’s state income tax rates. These rates range from 2% to 5%. However, Alabama does not tax income from pensions. The Retirement Systems of Alabama - Public Plans Data A comprehensive look at pension plan and pension cost data for each state.

Retirement Systems of Alabama (2) The Teachers' Retirement System of Alabama will pay the necessary expenses, round-trip travel at the prevailing state rate, and the physician's fee for an examination, to have questionable disability requests examined by physicians designated by the Teachers' Retirement System at the request of the Medical Board of the Teachers' Retirement ...

Alabama state retirement

Retired State Employee List - SPD - State of Alabama ... State of Alabama website (opens in new window) State Employees' Insurance Board(SEIB) (opens in new window) State Retirement Systems(RSA) (opens in new window) Division of Risk Management (opens in new window) Alabama Career Center (opens in new window) ... Please choose Retired State Employee with a General or Law Enforcement Option. * Name: STATE OF ALABAMA ETHICS COMMISSION Feb 24, 2022 · STATE OF ALABAMA ETHICS COMMISSION Mailing Address Street Address P.O. Box 4840 Montgomery, AL RSA Union 100 North Union Street 36103-4840 Suite 104 Montgomery, AL 36104 Thomas B. Albritton Director Telephone: (334) 242-2997 Fax: (334) 242-0248 Web Site: 1 of 63 The Retirement Systems of Alabama The Retirement Systems of Alabama We are the safe keepers of pensions for thousands of Alabamians and we take our jobs seriously. It is our goal to seek and secure the best investments and services for our membership, and to ensure that we do everything possible to help our members prepare for and enjoy a successful retirement.

Alabama state retirement. Employees' Retirement System The Employees' Retirement System (ERS) was established in 1945 to provide ... Alabama Administrative Code Alabama Legislative Services Agency Alabama State house 11 South Union Street Montgomery, AL 36130 P: (334)261-0600 What Are Alabama Tax Laws for Retirement and Social Security ... Mar 26, 2021 · Alabama does recognize Roth IRA and Roth 401(k) plan distributions as tax-free, matching the federal treatment of these retirement accounts. (For more on IRAs and how they work, head on over to ... Teachers' Retirement System of Alabama (TRS) | University of North ... Alabama's oldest public 4-year university located within a four-city area on the Tennessee River known as the Shoals

Alabama Retirement System | Pension Info, Taxes, Financial Health November 28, 2018 - Here we take a look over the Alabama retirement system, including the different plans, programs and taxes that are involved in the state... 5 Retirement Systems of Alabama (RSA) myths and the truth they ... August 25, 2015 - This summer has been marked by ... system, the Retirement Systems of Alabama (RSA). Sparked by upsetting revelations that the RSA owned almost half of a company involved in human trafficking, the resulting concern and inquiries into the RSA by the public, state leaders ... Active Members | The Retirement Systems of Alabama When am I eligible to retire? Tier 1 member: You are eligible to retire at any ... Georgia moves to exempt military retirement pay from taxes ... The first $35,000 of any retirement income for Georgia residents 62 to 64 is exempt from state income taxes, while the first $65,000 of retirement pay is exempt for Georgia residents 65 and older.

How To Calculate Alabama State Retirement? - Ozark Is Alabama A Good State To Retire To? Ranking sixth among states in the U.S. when it comes to retirement security is Alabama. Although there is a mild winter, a wide choice of beaches, and a vibrant golf season, Alabama's per capita income is 13% lower than national averages. - SPD - State of Alabama Personnel Department State Retirement Systems(RSA) (opens in new window) Division of Risk Management (opens in new window) Alabama Career Center (opens in new window) Department of Labor (opens in new window) Employees' PerksCard Website (opens in new window) ... The list below contains job classes that are part of the State Professional Trainee program. Calculators | The Retirement Systems of Alabama ERS and TRS Retirement Calculator (Registered MOS Users) - The online calculator ... Alabama - National Association of State Retirement ... The Retirement System of Alabama administers pension and other benefits to most public employees in Alabama. The system consists of the Teachers' Retirement System and the Employees' Retirement System, which includes state employees, state police officers, and employees of political subdivisions ...

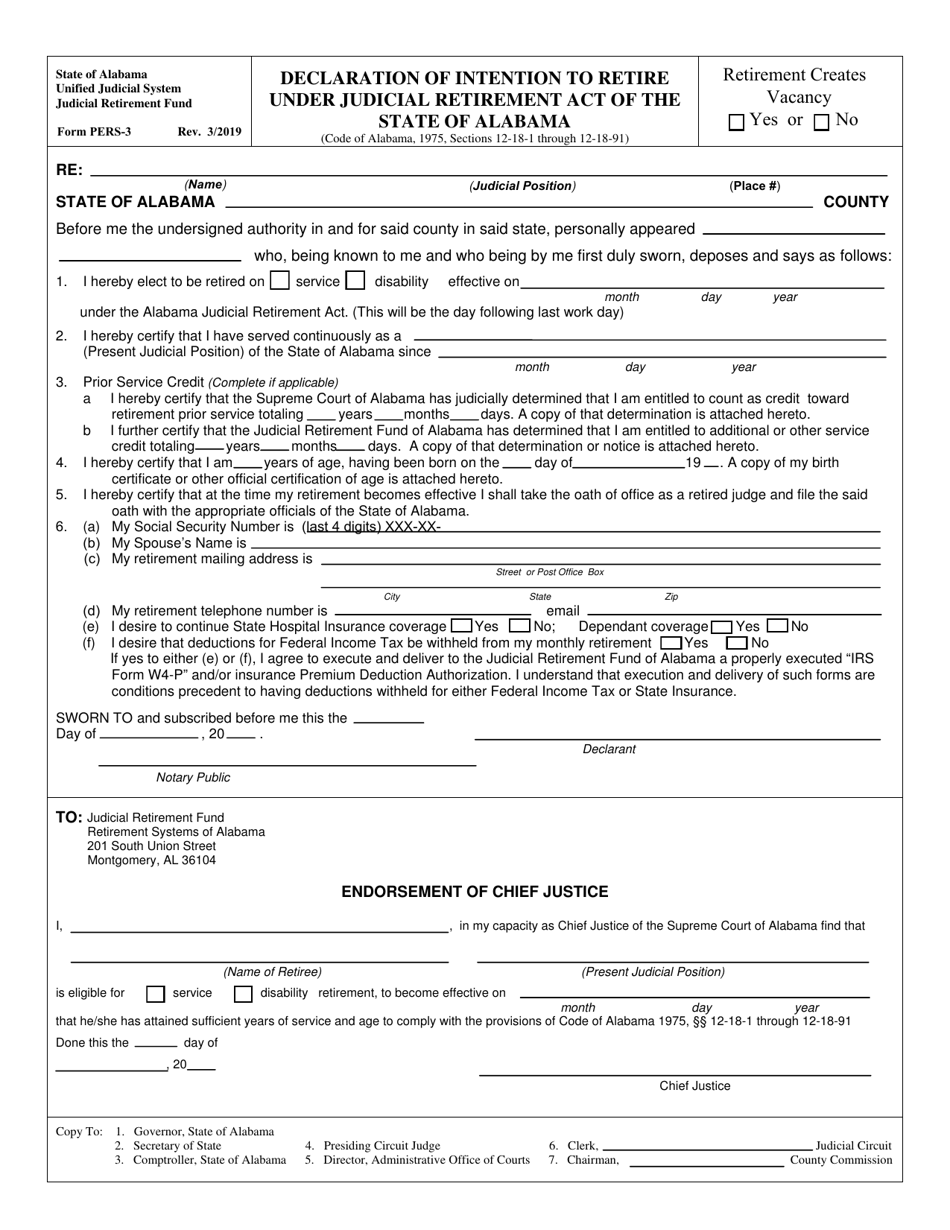

Alabama - NASRA The Retirement System of Alabama administers pension and other benefits to most public employees in Alabama. The system consists of the Teachers' Retirement System and the Employees' Retirement System, which includes state employees, state police officers, and employees of political subdivisions that have elected to participate.RSA also administers the Judicial Retirement Fund.

Alabama State Pension Plans | Pension Retirement Alabama offers three main types of pension plans, depending on your job qualifications and tenure of service. Enrollment in these individual plans is controlled

ERS Retirees | The Retirement Systems of Alabama I am the beneficiary of a deceased retired member. How do I get the benefits ...

Benefits of State Employment - SPD - State of Alabama ... The State of Alabama and its agencies reserve the right, at its discretion, to alter any or all plans and benefits described in this summary for any reason at any time with or without notice Retirement

Retirement Program | Alabama State University To file for retirement benefits, ... date of retirement. *If death occurs more than 180 calendar days after the member's last day in pay status or if the deceased had applied for a refund of contributions or terminated employment, the lump-sum payment will be the same as for status of less than 1 year and not job-related. ... Alabama State University ...

ERS Forms | The Retirement Systems of Alabama Forms. Change; Purchase Service or Transfer; Retirement / Disability ...

Retirement Systems of Alabama | LinkedIn 750 million+ members | Manage your professional identity. Build and engage with your professional network. Access knowledge, insights and opportunities.

State and Local Consumer Agencies in Alabama | USAGov Alabama State Banking Department, Montgomery, AL Website: State Banking Department ; Phone Number: 334-242-3452. Toll Free: 1-866-465-2279. Insurance Regulators. Each state has its own laws and regulations for each type of insurance. The officials listed in …

ERS Employers | The Retirement Systems of Alabama Retirement Employer Cost Rates effective October 1, 2020 (State Only) · Tier 1 ...

Alabama state retirees could get $300 bonus in 2022 under ... Legislation sponsored by Sen. Del Marsh, R-Anniston would provide a one-time bonus of at least $300 to state employees, depending on their length of service. Those who retired before March 1, 2022 would be eligible. The bonus would also be available to retirees of local governments who have opted into Retirement Systems of Alabama, though those ...

Home Page - SPD - State of Alabama Personnel Department State of Alabama website (opens in new window) State Employees' Insurance Board(SEIB) (opens in new window) State Retirement Systems(RSA) (opens in new window) Division of Risk Management (opens in new window) Alabama Career Center (opens in new window) Department of Labor (opens in new window) Employees' PerksCard Website (opens in new window)

Is Alabama a Good State to Retire In? | Acts Retirement Here are five reasons why the Heart of Dixie should be a top of your retirement destination list! 1. Tax-Friendly and Affordable. According to Kiplinger.com, Alabama is the "most tax-friendly" state in the country. Social security benefits, payments from pension plans, and income from the federal government are all exempt.

Job Opportunities - SPD - State of Alabama Personnel ... The hourly, conditional Retired State Employee classification is used by various agencies to reemploy individuals who have retired from the State of Alabama. To be eligible for this classification, you must be a State retiree currently receiving retirement benefits from the Employees' Retirement System, the Teachers' Retirement System, or ...

Mandatory Retirement (Retirement Systems of Alabama) | Office of ... February 18, 2021 - Please review our Privacy Statement for more information. ... As a condition of employment at the University, all eligible employees in at least a 50 percent time capacity are required to join the Retirement Systems of Alabama (RSA). This program provides specific benefits for eligible members ...

Contact Us | The Retirement Systems of Alabama Street Address 201 South Union Street Montgomery, Alabama 36104 ; Mailing Address

Retirement Plans – Human Resources | The University of Alabama The University of Alabama is proud to offer our employees retirement savings plans provided by one of the leading financial services companies in the country: TIAA. All University employees may choose to contribute to one or both of our 403(b) or 457(b) retirement savings plans, contributing ...

Testing - SPD - State of Alabama Personnel Department State of Alabama website (opens in new window) State Employees' Insurance Board(SEIB) (opens in new window) State Retirement Systems(RSA) (opens in new window) Division of Risk Management (opens in new window) Alabama Career Center (opens in new window) Department of Labor (opens in new window) Employees' PerksCard Website (opens in new window)

Teachers' Retirement System | The Retirement Systems of Alabama TEACHERS' RETIREMENT SYSTEM. Since 1939, The Teachers' Retirement System (TRS) has provided benefits to qualified members employed by state-supported educational institutions, including public employees of K-12 school systems, two-year Community Colleges, four-year higher education institutions, and state education agencies.

Retirement Systems of Alabama - Wikipedia Retirement Systems of Alabama is the administrator of the pension fund for employees of the state of Alabama. It is headquartered in the state capital Montgomery, Alabama. David G. Bronner is the chief executive officer.

Retirement Systems of Alabama | Facebook See posts, photos and more on Facebook

Retirement Calculator Welcome to the RSA Retirement Benefit Estimate Calculator. The Retirement ...

Login - The Retirement Systems of Alabama Your session is about to expire due to inactivity. Click OK to extend your session or click Cancel to log out now · Hours of Operation: 8:00am-5:00pm CT Phone: 334.517.7000 or Toll Free: 877.517.0020

Alabama Retirement System | Pension Info, Taxes, Financial ... Each state has a retirement system, but they vary in size and complexity. The organization that runs the systems in Alabama is called the Retirement Systems of Alabama. According to a 2017 report, there are more than 300,000 people participating in the state's retirement plans and they earned about $3 billion worth of benefits in 2017.

error.headingTitle - Empower Retirement {{accuCustomization.metaTags.description}} {{("logon." + authentication.errorMessage) | translate:authentication.errorMessageParams}} {{"logon.logonTitle" | translate}}

Taxes in Alabama to Iowa - Retirement Living Retirement Income Taxes: Alabama does not tax any retirement income. Retired Military Pay: No tax. Survivor benefits not taxed. Property Taxes. Alabama’s effective property tax ranks among the lowest in the nation at 0.42%. Homeowners pay $854 on a $205,000 home. Each county may charge an additional property tax.

RSA Retirement Benefit Estimate Calculator RSA Retirement Benefit Calculator Step 1. Enter at least three (3) letters of the name of the agency or school system by whom you are employed. For example, TUSC will select all employers with TUSC anywhere in the name. (NOTE: Cities and Towns are referenced by name only; i.e., CITY OF HOOVER is shown as HOOVER.)

ALABAMA STATE PERSONNEL BOARD ALABAMA STATE … The State of Alabama Deferred Compensation Plan offers you powerful tools to help 2.50 w 4.50 w you reach your retirement dreams. This Plan allows you to save and invest extra money . for retirement. You will be able to save and invest consistently and automatically, choose

Pay Plan (Salary Schedule) - SPD - State of Alabama ... Class: 10876 Senior Retirement Counselor Grade: 74 Act# 2005-316 REQUIRES STATE EMPLOYEES TO BE PAID AT A SEMI MONTHLY RATE. THE COMPARISON TABLE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY.

The Best And Worst States For Retirement 2021: All 50 ... The state scores well on culture (No. 15). If you're looking for retirement-age friends, you'll have a good chance of finding them in this state where 21 percent of the population is 65 and ...

The Retirement Systems of Alabama The Retirement Systems of Alabama We are the safe keepers of pensions for thousands of Alabamians and we take our jobs seriously. It is our goal to seek and secure the best investments and services for our membership, and to ensure that we do everything possible to help our members prepare for and enjoy a successful retirement.

STATE OF ALABAMA ETHICS COMMISSION Feb 24, 2022 · STATE OF ALABAMA ETHICS COMMISSION Mailing Address Street Address P.O. Box 4840 Montgomery, AL RSA Union 100 North Union Street 36103-4840 Suite 104 Montgomery, AL 36104 Thomas B. Albritton Director Telephone: (334) 242-2997 Fax: (334) 242-0248 Web Site: 1 of 63

Retired State Employee List - SPD - State of Alabama ... State of Alabama website (opens in new window) State Employees' Insurance Board(SEIB) (opens in new window) State Retirement Systems(RSA) (opens in new window) Division of Risk Management (opens in new window) Alabama Career Center (opens in new window) ... Please choose Retired State Employee with a General or Law Enforcement Option. * Name:

/cloudfront-us-east-1.images.arcpublishing.com/gray/7RYHROW3LBFN3AGM7CBEAET4AQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/3FHYQVZCJFCHDDZB7JSIMQSUUM.jpg)

0 Response to "41 alabama state retirement"

Post a Comment