41 defined contribution pension death

Defined Benefit | When a member dies - Pension With a survivor pre-retirement and dependent children. Your survivor pre-retirement will receive a monthly pension equal to at least 50% of your unreduced pension or a commuted value. Each dependent child will receive a monthly pension equal to 10% of your unreduced pension, to a maximum of 40% shared equally among all dependent children. Death Benefits - Defined Contribution Schemes The taxation of death benefits is dependent on two factors: 1. Whether the member's death occurred before age 75 or at age 75 and over; and. 2. If the member's death occurred before age 75, whether those death benefits were paid out within the two-year window, from either: uncrystallised benefits; or. lump sum death benefit paid out from ...

Defined Contribution Pension Plan Death Benefit Application Defined Contribution Pension Plan Death Benefit Application _____ Complete all applicable sections and return pages 1-3 to: Southern California Pipe Trades Administrative Corporation Defined Contribution Department 501 Shatto Place, 5th Floor Los Angeles, CA 90020 Save “Your Rollover Options” for your records. (800) 595-7473 OR (213) 385-6161

Defined contribution pension death

Chancellor abolishes 55% tax on pension funds at death ... Around 320,000 people retire each year with defined contribution pension savings; these people will no longer have to worry about their pension savings being taxed at 55% on death. Are Pension Death Benefits Taxable? - HelpAdvisor If pension death benefits involve a defined-contribution plan such as a 401(k) or are paid as a lump sum distribution, there may be an option to roll them over into a new retirement plan. Rollovers may allow beneficiaries the option to continue growing their income in a tax-deferred environment until they're ready to begin receiving payments. What happens to your pension when you die? - Aviva A defined contribution pension — a pension that's based on how much has been paid into it — will normally pay the value of your pension pot in a lump sum to your dependants. If you die before age 75, benefits under money purchase schemes can usually be passed on to your beneficiaries free of tax.

Defined contribution pension death. Defined Contribution Pension schemes What is a defined contribution pension ? Defined contribution pensions can be: workplace pension schemes set up by your employer, or private pension schemes set up by you. If you're a member of a pension scheme through your workplace, then your employer usually deducts your pension contributions from your salary before it is taxed. Death benefits from a defined benefit pension scheme | Tax ... Published 09 Feb 2022 21:55. The following Employment Tax guidance note Produced by Tolley in association with John Hayward provides comprehensive and up to date tax information covering: Death benefits from a defined benefit pension scheme. Introduction. Lump sum death benefits ― before benefits have been crystallised. What happens to your pension when you die? | PensionBee Defined contribution pensions The main pension rule governing defined contribution pensions in death is your age when you die and whether you've already started drawing your pension. If you die before your 75th birthday and haven't started drawing your pension it can be passed to your beneficiaries tax-free. Pension death benefits 'indefensibly generous' | Financial ... Rule changes in 2015 allowed any unused cash left in a defined contribution personal pension to be passed to beneficiaries and heirs tax free if the pension holder died before the age of 75.

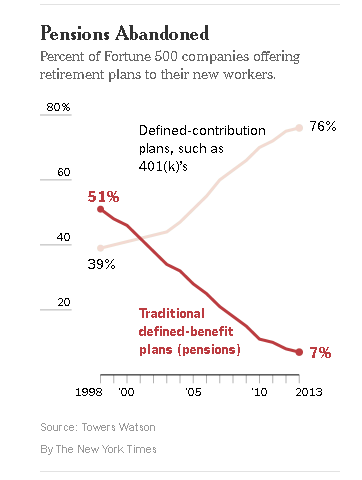

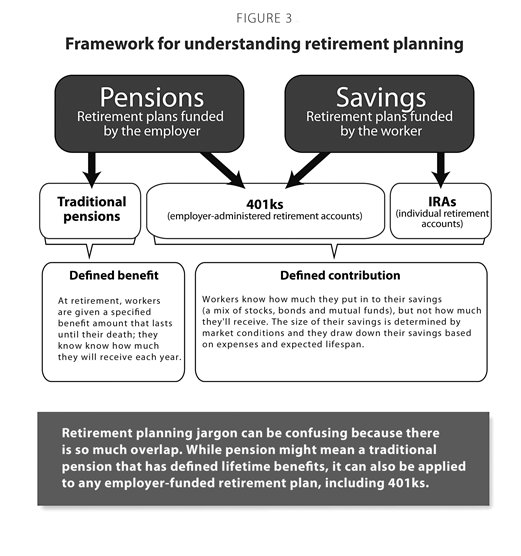

Defined-Contribution Plan Definition The defined-contribution plan differs from a defined-benefit plan, also called a pension plan, which guarantees participants receive a certain benefit at a specific future date. What to do about someone's pension when they've died ... Different tax rules apply to the rules when inheriting a defined contribution pension. It depends on whether the individual died before or after the age of 75. ... However, if the pension is claimed more than two years after the pension holder's death, tax might be payable. Tax on a private pension you inherit - GOV.UK A pension from a defined benefit pot can usually only be paid to a dependant of the person who died, for example a husband, wife, civil partner or child under 23. It can sometimes be paid to... Defined contribution pensions - BDO Relaxation of tax charges for pension funds on death after age 75 It has long been the case that if an individual dies before taking any pension benefits (and before age 75), the fund remains outside the individual's estate for inheritance tax (IHT) purposes and there is no exit charge on funds paid to their nominated beneficiaries.

Defined-Benefit vs. Defined-Contribution Plan Differences As the names imply, a defined-benefit plan—also commonly known as a traditional pension plan —provides a specified payment amount in retirement. A defined-contribution plan allows employees ... What happens to my pensions after death? | The Private Office If you have built up substantial funds in your pensions during your working life and have not taken any benefits from them and subsequently die before your 75th birthday your defined contribution pension funds and any defined benefit lump sums will be tested against your Lifetime Allowance. What is a defined contribution pension? | PensionBee What is a defined contribution pension? A defined contribution pension is the most common type of pension. On retirement, the amount your defined contribution pension is worth depends on how much money you've contributed and the performance of your investments. Most modern workplace and personal pensions are defined contribution pensions. Retirement Topics - Death | Internal Revenue Service Sep 27, 2021 · Retirement Topics - Death. When a participant in a retirement plan dies, benefits the participant would have been entitled to are usually paid to the participant’s designated beneficiary in a form provided by the terms of the plan (lump-sum distribution or an annuity). ERISA protects surviving spouses of deceased participants who had earned a ...

Death benefits from defined contribution schemes Death benefits from occupational defined contribution schemes may not offer full flexibility of death benefits. Death benefits are usually tax-free if the member dies when they are under 75, they are settled within two years of the scheme administrator becoming aware and the lump sum is within the member’s lifetime allowance.

Inherited Pension Benefit Payments From Deceased Parents Apr 25, 2021 · Defined-Contribution Pension . With a defined-contribution plan, such as a 401(k), the beneficiary can access remaining funds in the retirement account via a gradual drawdown, lump sum payment, or ...

What happens to your pension when you die? - Aviva A defined contribution pension — a pension that's based on how much has been paid into it — will normally pay the value of your pension pot in a lump sum to your dependants. If you die before age 75, benefits under money purchase schemes can usually be passed on to your beneficiaries free of tax.

Are Pension Death Benefits Taxable? - HelpAdvisor If pension death benefits involve a defined-contribution plan such as a 401(k) or are paid as a lump sum distribution, there may be an option to roll them over into a new retirement plan. Rollovers may allow beneficiaries the option to continue growing their income in a tax-deferred environment until they're ready to begin receiving payments.

Chancellor abolishes 55% tax on pension funds at death ... Around 320,000 people retire each year with defined contribution pension savings; these people will no longer have to worry about their pension savings being taxed at 55% on death.

0 Response to "41 defined contribution pension death"

Post a Comment